Licensed to Help: A Legal Expert’s Guide to Public Adjuster Ethics

January 7, 2025 | Reading Time: 10 Minutes

Licensed to Help: A Legal Expert’s Guide to Public Adjuster Ethics

By Brian S. Goodman, Esq. & General Counsel of NAPIA, and Arianna Armelli, Founder & CEO of Dorothy

About the Authors

Brian S. Goodman, Esq.,

Brian S. Goodman, Esq., is a Maryland attorney with over 40 years of experience specializing in tort and insurance litigation. He has extensive experience in general liability claims, personal injury cases, and first party property claims. Brian has served as General Counsel of the National Association of Public Insurance Adjusters (NAPIA) and is a board member of the Coalition Against Insurance Fraud.

Arianna Armelli

Arianna Armelli is the Founder and CEO of Dorothy, a data and technology company providing advanced storm intelligence and claims-readiness tools to public adjusters, attorneys, and restoration professionals. With a background in architecture, urban resilience, and climate modeling, she has spent over a decade building solutions that bridge weather, science, property risk, and the claims ecosystem.

A New Kind of Partnership: Why Dorothy Joined This Conversation — A note from our CEO, Arianna Armelli

Dorothy was founded after hearing hundreds of firsthand stories from policyholders dealing with delayed insurance payments — not because of missing paperwork, but due to prolonged disputes and opaque claim processes that the average policyholder has little experience navigating. These delays often left policyholders confused, financially strained, and unsure of what steps to take next.

In the early days, we believed the core issue was timing — that carriers simply took a long time to pay claims. Our initial solution focused on bridging that gap, offering short-term cash advances to help homeowners get through the waiting period between filing a claim and receiving payment. But through that work, we had the opportunity to speak directly with hundreds of policyholders and insurance specialists; a more serious issue became clear.

Many policyholders didn’t fully understand what their policies covered, why their claims were being disputed, or how those disputes impacted their final settlement. More critically, they didn’t know who to turn to for legitimate advocacy when the process became delayed or adversarial.

That realization shaped what we became next. Today, Dorothy works to improve access to clear information and trusted, licensed professionals through tools that help policyholders verify credentials, understand their options, and connect with ethical public adjusters and attorneys.

As we continued this work, we also saw a broader imbalance take shape. While significant investment has flowed into technology built for main insurance carriers, far less attention has been given to the licensed professionals working on the policyholder’s side of the process. Dorothy’s tools were built to help close that gap, supporting ethical public adjusters and disaster recovery professionals with better access to information, verification, and compliant ways to serve the people who rely on them.

This article reflects that shared commitment: helping policyholders understand the rules, identify responsible professionals, and avoid the risks that come from navigating complex claims alone.

The Policyholders’ Guide to Ethical Public Adjusting

As the saying goes, “When it rains, it pours.” For policyholders, the aftermath of the storm often brings more than water or wind damage. It can be a chaotic time, often marked by delays in the insurance process, a rush of unsolicited assistance, or both.

Property recovery requires clear decisions made under pressure. But instead of getting reliable help, many policyholders and business owners face a different challenge: identifying who is legally authorized to advise them. That uncertainty creates a vulnerable window, often filled by well-meaning, yet unqualified individuals offering help they are not legally allowed to provide.

This uncertainty is exactly why platforms like Dorothy have stepped in — not to replace the profession, but to reinforce it. By verifying licenses, tracking outreach, and connecting policyholders only with vetted adjusters, technology can help close the gaps that have historically left policyholders vulnerable.

Still, in the stressful days after a storm, it can be difficult to tell who is qualified and who isn’t. Even well-intentioned individuals can overstep, and the consequences can be serious. That’s why understanding the distinction between lawful public adjusting services and prohibited solicitation is critical.

This article outlines the key solicitation laws, the common missteps policyholders may encounter after a storm, and the steps they can take to protect themselves.

1. The Ethical Line: What Help Is Legal, and What Isn’t?

In nearly every state, only two professionals are legally allowed to negotiate or interpret an insurance claim on your behalf:

A licensed public adjuster

A licensed attorney

Anyone else — a roofer, restoration contractor, handyman, “claims consultant,” or general contractor — steps into illegal territory the moment they start dealing with your insurer for you. This is called the Unauthorized Practice of Public Adjusting (UPPA), and it’s more common than most people realize.

UPPA can void contracts, delay settlements, trigger disputes, and leave policyholders without recourse if something goes wrong. The key is working with someone who’s licensed, trained, and bound by rules that protect you. And when that person isn’t licensed, the consequences fall entirely on the policyholder.

Public adjusters are also frequently misunderstood. Some insurance industry messaging has cast PAs as “predatory,” which leaves policyholders unsure about who to trust. In reality, licensed public adjusters operate under strict ethical rules and take those obligations seriously. Like any profession, there are a few bad actors — but broad stigma only pushes homeowners toward the actual risk: unlicensed individuals operating without any ethical or legal accountability.

These laws aren’t red tape. They exist so that, on your worst day, you have someone who’s actually qualified to sit on your side of the table. — Brian Goodman, Esq.

2. What a Licensed Public Adjuster Actually Does

Think of a public adjuster as your claims advocate: someone who knows the laws, understands your policy, and represents your financial interests.

A licensed PA typically:

Inspects and documents the damage

Reads and interprets the policy coverage

Compiles estimates and claim documents

Negotiates the claim within the bounds of state law

Ensures the settlement reflects actual loss and coverage

This is not a casual skillset. In most states, public adjusters must complete licensing exams, pass background checks, secure bonding, and maintain ongoing continuing education—often including ethics requirements. They are also subject to regular renewal and compliance reviews every one to two years. That means there is a paper trail, a license to verify, and a state regulator watching. Contractors, roofers, and consultants provide valuable services but they cannot legally interpret coverage or negotiate claims unless they are separately licensed as PAs or attorneys.

Who’s Allowed to Negotiate Your Insurance Claim?

Public Adjuster

Who They Work For

The policyholder (you)

What They Can Negotiate

Full insurance claim value on your behalf

Regulation

State-licensed and regulated

Attorney

Who They Work For

The policyholder (usually in legal disputes)

What They Can Negotiate

Legal aspects of claim, lawsuits, settlement

Regulation

Licensed by state bar associations

Contractor

Who They Work For

Themselves or hired by you

What They Can Negotiate

Scope of work, materials, timelines (NOT the claim)

Regulation

Licensed contractor, not permitted to negotiate insurance

Insurance Adjuster

Who They Work For

The insurance company

What They Can Negotiate

Claim amounts in favor of the insurer

Regulation

Employed by or contracted with insurer; state oversight

3. Where Things Go Wrong: The Everyday Forms of UPPA

The most common UPPA violations don’t come from bad intentions. they come from confusion and overconfidence. A roofer thinks he’s helping. A “consultant” believes he’s saving you time. Contractors, consultants, and sales reps overstep because they believe they’re helping, not because they intend to break the law. But by the time the policyholder realizes it, the damage is usually already done.

How a Claim Goes Off Track

1

Policyholder Starts Claim

Files initial claim after damage occurs.

2

Unlicensed Person Involved

A contractor or unlicensed person begins handling parts of the claim.

3

Claim Disrupted

Insurance company denies or delays the claim due to unauthorized negotiations.

4

Needs Professional Help

Policyholder hires a licensed adjuster or attorney to get the claim back on track.

Who Enforces UPPA?

UPPA enforcement can sometimes fall to the individual state departments of insurance, but these agencies often do not have any plenary power over contractors or roofers. Some states make UPPA a misdemeanor crime, and in those instances the jurisdiction and penalties are enforced by State prosecutorial agencies, such as the Attorney General or States’ attorneys office. As a result of this reality, many violations slip through due to understaffed agencies or the fact that these are not typical crimes subject to quick prosecution. This gap allows unlicensed actors to operate for longer than they should, without accountability for the harm they cause. This creates confusion for policyholders and frustration for ethical, licensed professionals.

4. How Dorothy Is Addressing the Access Gap

Dorothy approaches this problem as a technology company focused on clarity and access, working alongside existing rules and enforcement frameworks.

Licensing plays an important role in protecting policyholders, but it is only one part of the picture. After a loss, people are often meeting professionals for the first time under stressful circumstances. In those moments, they need more than confirmation that someone is licensed. They need context. Who is this person? What kind of work have they done? Have others had good experiences working with them?

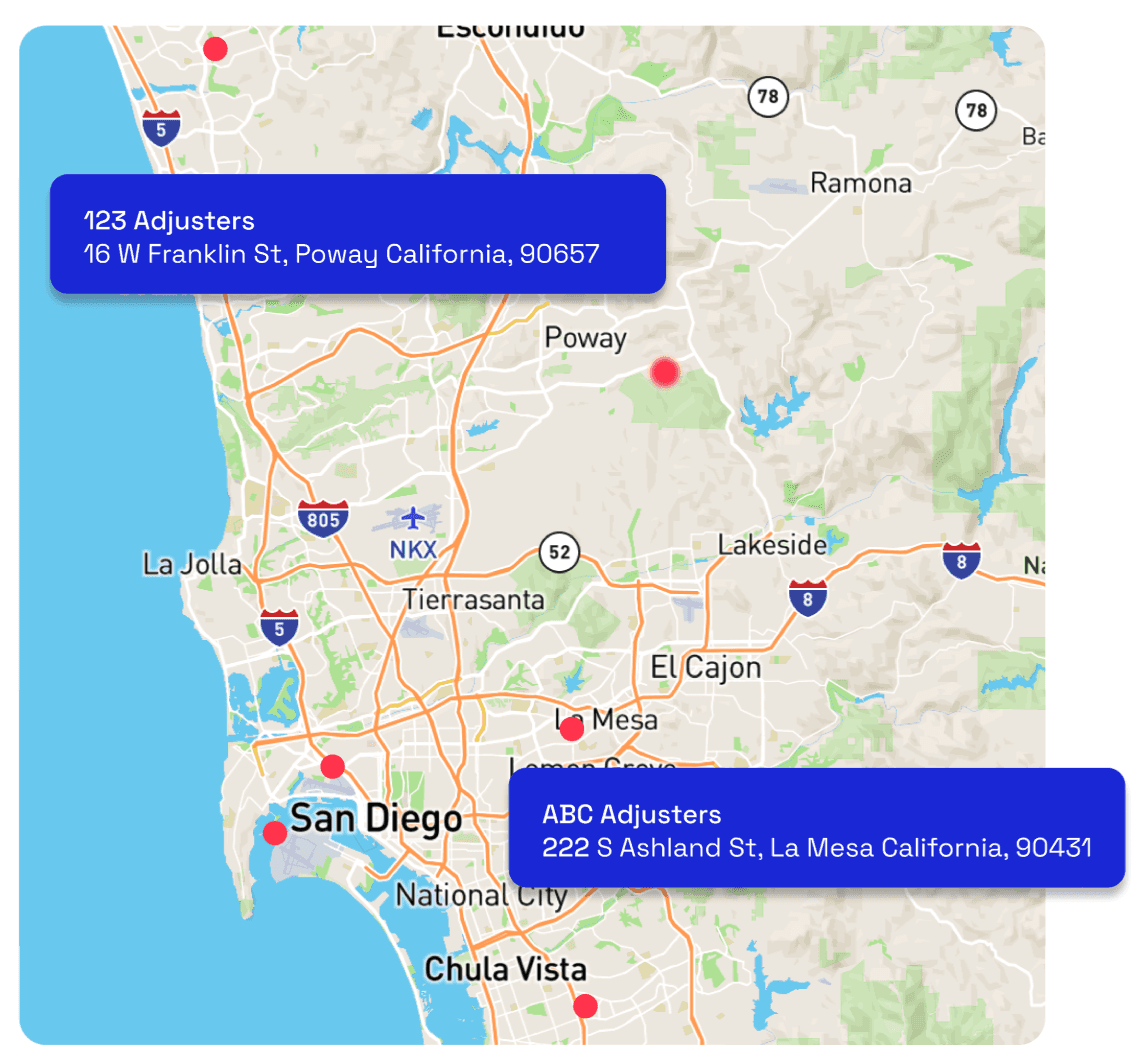

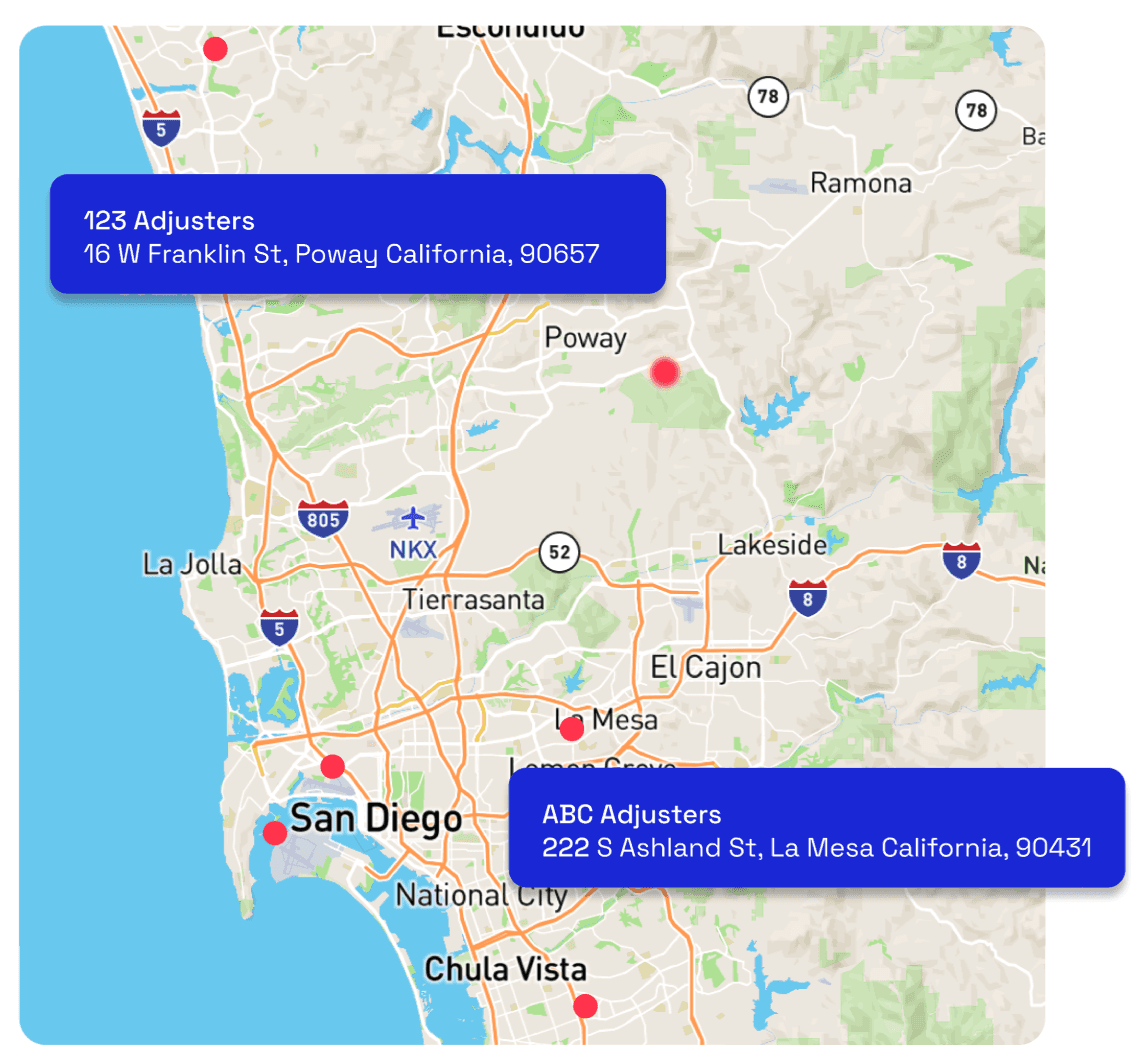

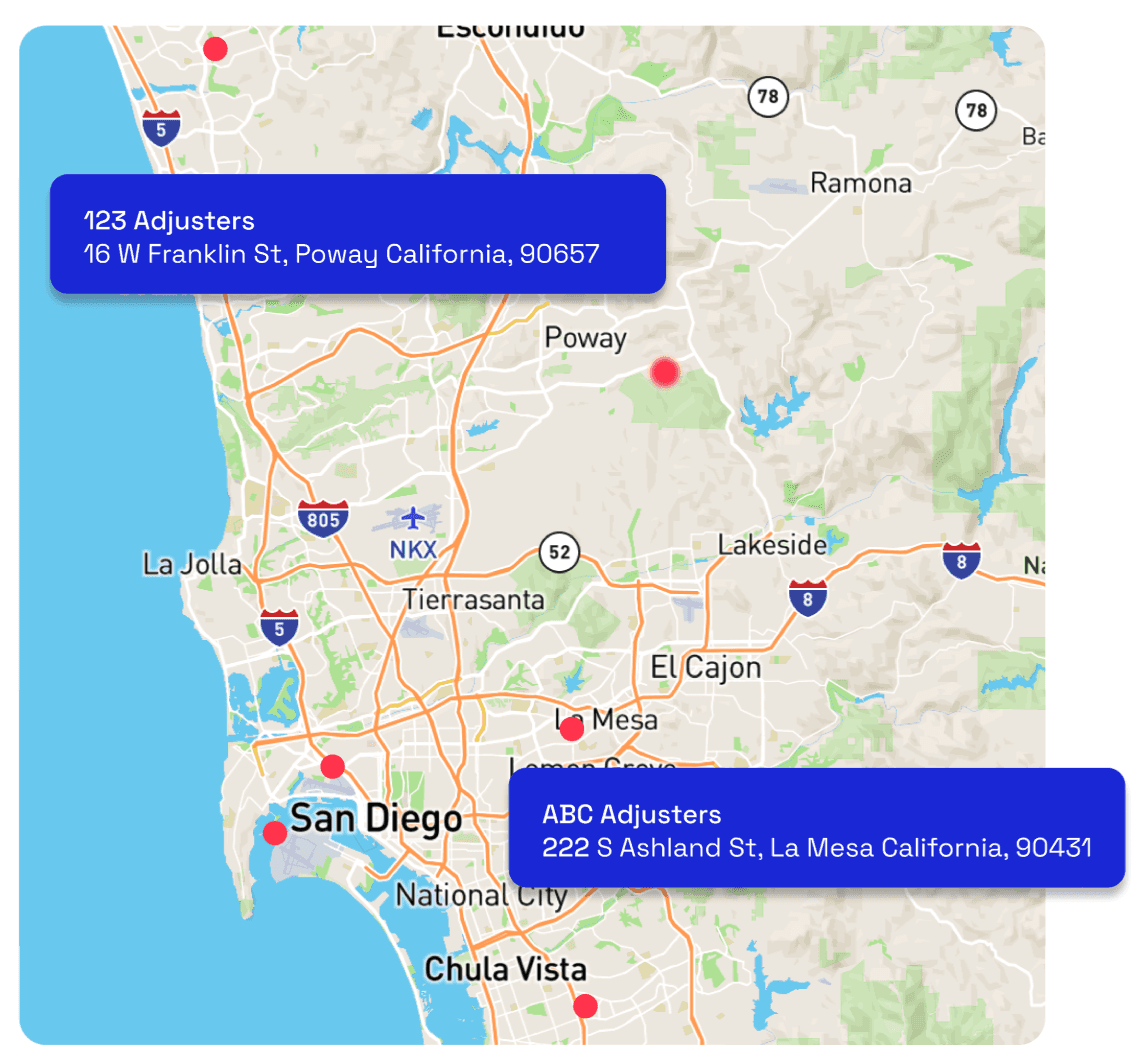

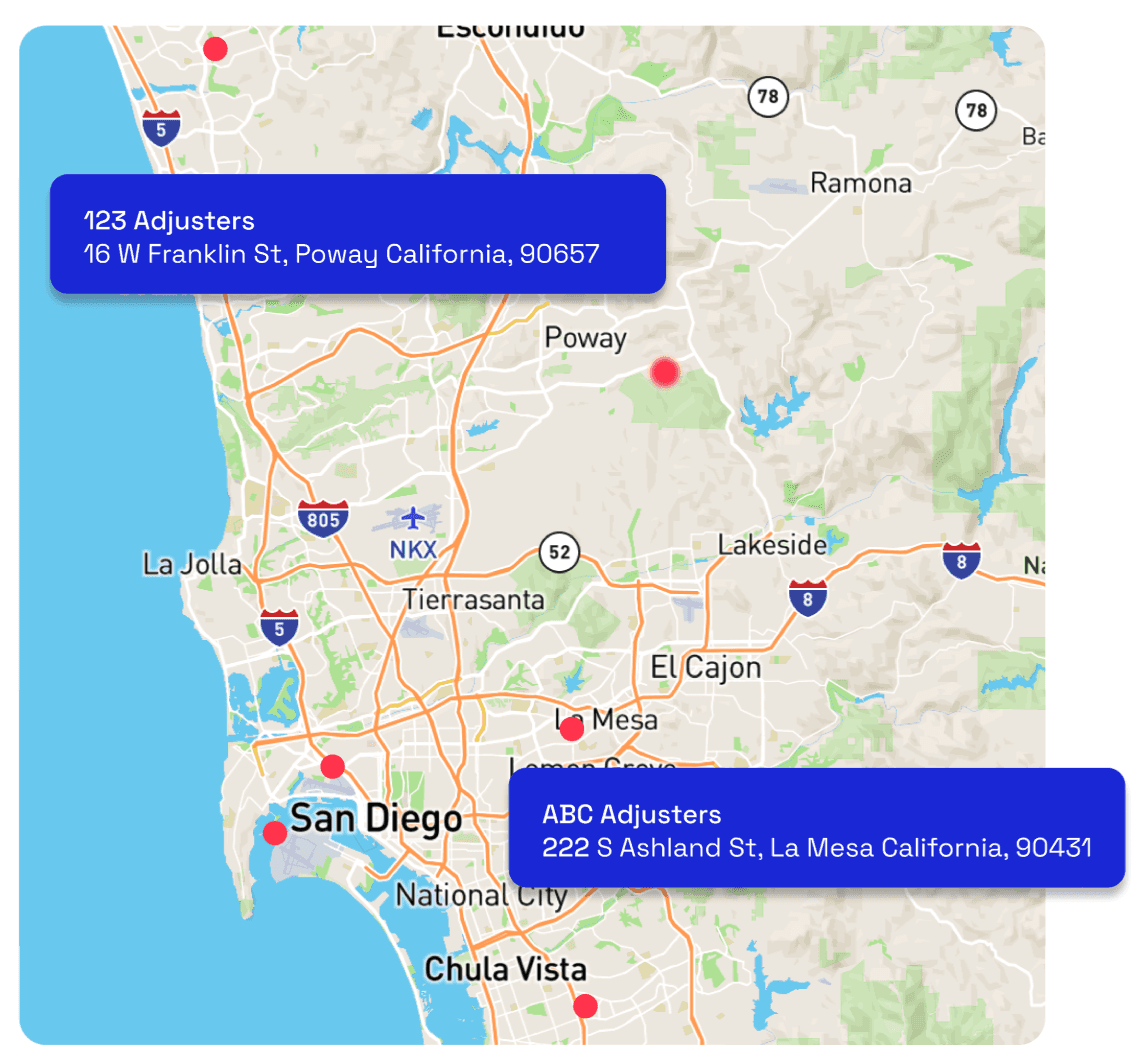

This reality is one of the reasons Dorothy built Bestpublicadjuster.org, a free, public-facing directory designed to help policyholders verify a professional’s license before ever taking a first meeting, and to better understand who they are choosing to work with.

Policyholders can check credentials, reviews, and service areas, and book consultations without pressure or uncertainty. By making this information easier to access upfront, Dorothy aims to support the work of regulators, reduce confusion for homeowners, and help ethical professionals stand out in moments when trust matters most.

Awareness around licensed public adjusters is still far too low, and that gap allows unlicensed individuals to step into roles they legally shouldn’t. We built Bestpublicadjuster.org to change the landscape: to elevate licensed PAs, broaden consumer understanding, and give policyholders a trusted way to verify a professional before they engage. — Arianna Armelli, Founder & CEO of Dorothy

5. Ethical vs. Unethical Solicitation: How to Tell the Difference

When stress is high, quick decisions can backfire. It’s important to slow things down and vet anyone offering help.

Ethical Behaviors (Green Flags)

Provides full name + license number immediately

Shows you how to verify their license

Offers a clear, compliant written contract

Encourages you to take your time, ask questions, or consult others

Explains fees & costs transparently

Unethical or Illegal Behaviors (Red Flags)

Pressure to sign immediately

Implying state, FEMA, or insurance affiliation without proof

Asking you to sign over your insurance check

Refusing to give a license number

Contracts full of vague or overly broad language

5.1 Technology’s Role in Raising the Bar

Technology can support ethical practices when it is built with a clear understanding of the rules that already exist. At Dorothy, that means learning directly from legal and industry experts like Brian Goodman as we build and refine our platform.

We work with experts to understand how solicitation laws vary by state and where confusion most often occurs, using that insight to shape how our tools encourage compliant, ethical use. That guidance informs how professionals are verified and how policyholders are invited to engage.

Every public adjuster listed through Dorothy and BestPA.org must meet strict licensing and ethical standards. Licenses are verified with state Departments of Insurance, and unlicensed individuals, or consultants are not permitted on the platform. Policyholders can review credentials, background information, and service details before scheduling a consultation.

Ethics require more than rules on paper. Our role as a technology company is to build systems that make ethical choices easier.

If someone tells you they’re a public adjuster, you should be able to verify that license in minutes. If you can’t find them on your Department of Insurance website, that’s your sign to walk away. — Brian Goodman, Esq.

6. Why Ethics Matter And Who They Protect

Ethics in public adjusting are about people. When adjusters follow legal and ethical standards:

Policyholders get fair, timely settlements

Insurers experience fewer disputes

Contractors get clearer scopes

Communities recover faster

When they don’t, ripple effects spread across everyone involved. Claims get delayed and the trust that should exist between consumers and professionals erodes.

This is also where technology and transparency tools — including platforms like Dorothy — can help rebuild trust. By verifying licenses, tracking outreach, and giving policyholders clarity, tech can support ethical professionals and create better outcomes.

Reform, Oversight, and What’s Coming Next

The industry isn’t standing still. States like Texas and Oklahoma have introduced clearer rules around solicitation, contract standards, and UPPA enforcement. National organizations like NAPIA continue pushing for stronger consumer protections and consistent licensing requirements. As states strengthen their UPPA and solicitation rules, technology will play a bigger role in enforcement and consumer education. Platforms like Dorothy can help regulators, adjusters, and policyholders align around a shared goal: a clearer, more trustworthy claims process.

Real improvement comes from giving the rules we already have real weight. That means consistent enforcement, clear expectations, and resources for regulators to act when something goes wrong. Tools that help connect licensed adjusters with the policyholders who need them can also bring more order and transparency to the process.

Recovering from property damage is exhausting. No one should have to face complex insurance issues alone. Ethical public adjusting ensures policyholders receive the support, clarity, legal protection, and advocacy they deserve — from someone who’s truly on their side and licensed to help.

We are not public adjusters, and we do not pretend to be. What we do care about is helping people recover after disaster and building technology that supports the professionals who advocate for them. When the right tools, information, and people come together, recovery becomes clearer, fairer, and faster. — Arianna Armelli, Founder & CEO of Dorothy

6. Why Ethics Matter And Who They Protect

Ethics in public adjusting are about people. When adjusters follow legal and ethical standards:

Policyholders get fair, timely settlements

Insurers experience fewer disputes

Contractors get clearer scopes

Communities recover faster

When they don’t, ripple effects spread across everyone involved. Claims get delayed and the trust that should exist between consumers and professionals erodes.

This is also where technology and transparency tools — including platforms like Dorothy — can help rebuild trust. By verifying licenses, tracking outreach, and giving policyholders clarity, tech can support ethical professionals and create better outcomes.

Reform, Oversight, and What’s Coming Next

The industry isn’t standing still. States like Texas and Oklahoma have introduced clearer rules around solicitation, contract standards, and UPPA enforcement. National organizations like NAPIA continue pushing for stronger consumer protections and consistent licensing requirements. As states strengthen their UPPA and solicitation rules, technology will play a bigger role in enforcement and consumer education. Platforms like Dorothy can help regulators, adjusters, and policyholders align around a shared goal: a clearer, more trustworthy claims process.

Real improvement comes from giving the rules we already have real weight. That means consistent enforcement, clear expectations, and resources for regulators to act when something goes wrong. Tools that help connect licensed adjusters with the policyholders who need them can also bring more order and transparency to the process.

Recovering from property damage is exhausting. No one should have to face complex insurance issues alone. Ethical public adjusting ensures policyholders receive the support, clarity, legal protection, and advocacy they deserve — from someone who’s truly on their side and licensed to help.

If someone tells you they’re a public adjuster, you should be able to verify that license in minutes. If you can’t find them on your Department of Insurance website, that’s your sign to walk away. — Brian Goodman, Esq.

Topic

Public Adjusters

Subscribe

Join our newsletter to stay up to date on features and releases.

Licensed to Help: A Legal Expert’s Guide to Public Adjuster Ethics

Reading Time: 7 Minutes

Content

Redefining Property Loss Detection Through Unified Storm Intelligence

Download the full white paper

Claim the Critical Window: How Real-Time Data Empowers Faster, Fairer Recovery

Executive Summary

When severe weather strikes, information moves fast. Clarity often doesn’t. For public adjusters, restoration professionals, and property damage attorneys, the hours following a disaster are critical for preparation and coordination. The ability to assess impact quickly determines how effectively professionals can support policyholders once it is legally and ethically appropriate to do so.

Historically, disjointed data sources and information lag have made this difficult. Adjusters often rely on anecdotal reports, delayed weather data, or manual outreach lists. By the time accurate information becomes available, opportunities to assist property owners responsibly have already narrowed.

One of the biggest challenges adjusters face is that many policyholders don’t know who they are or why they need them until the claim becomes complex. Unified and enriched storm intelligence changes that. Technology like Dorothy empowers qualified professionals to respond with transparency and accuracy when owners need guidance most.

By combining real-time storm data, emergency dispatch intelligence, and satellite-based impact verification, Dorothy enables professionals to identify affected zones, verify property conditions, and prepare for response—ethically, efficiently, and in compliance with state-specific regulations.

This white paper explores how real-time intelligence can accelerate recovery, reduce wasted outreach, and establish a new industry standard for timely, compliant, and data-driven disaster response.

The Problem

1. The 48-Hour Information Gap

When a storm hits, information moves slower than the damage. Even with modern weather tech, most adjusters still face a gap between storm occurrence and actionable property insight. That delay causes:

Delayed Damage Awareness

Pain Point

Storm tracking data may not reflect actual property-level impacts for 24–48 hours.

Description

Missed early outreach window.

Consequence

Unverified Impact Zones

Pain Point

Radar-based maps can show storm paths but not actual loss locations.

Description

Countless hours wasted on properties that weren’t impacted.

Consequence

Fragmented Data Sources

Pain Point

Weather, dispatch, and property data are scattered across systems.

Description

No unified workflow; manual verification slows operations and data is often incomplete.

Consequence

Reliance On Instinct

Pain Point

Local intuition fills the data void.

Description

Inconsistent results; harder to scale across multiple markets.

Consequence

The Cost of Delay

When claims drag on, trust erodes. Adjusters and restoration professionals know that the longer it takes to get involved, verify damage, and guide policyholders through the process, the harder it becomes to achieve a fair, timely settlement. Once a claim is already in dispute, much of the work becomes undoing earlier missteps—costing both time and trust. Yet many firms still rely on fragmented data systems that delay when and how they engage. Dorothy technology helps bridge that gap by consolidating weather, dispatch, and property impact data into a single, reliable source of truth.

48%

The Awareness Gap

Only 48 percent of policyholders say they fully understand their home insurance policy.

80%

Claims Complexity

More than 80 percent of disaster survivors surveyed said they felt underprepared to handle the insurance claim process after a major loss.

>50%

Delayed At Scale

Over 50% of disaster-related claims remain unresolved six months after the event because critical loss data and verification arrive too late.

44 Days

The Carrier Bottleneck

The average U.S. homeowners property-damage claim now takes over 44 days from first notice of loss to final payment—the longest cycle time on record.

The Approach

2. Dorothy Alerts: A Framework for Real-Time Readiness

Dorothy’s Alert Solution integrates live feeds from multiple data layers, creating a unified operational map of every major weather event across the country.

2.1 What Makes Dorothy Different

Unlike conventional weather tracking tools that only provide forecasts or broad polygons, Dorothy connects the dots between:

Storm Intensity & Location

NOAA and radar feeds track the movement and magnitude of weather systems.

Property Intelligence Layers

Property data layers refine impact analysis by mapping damage across defined asset types—such as commercial buildings and dense residential areas—to support more accurate assessment and planning.

Historical Trend Data

Property data layers link verified structures to areas of potential impact.

Visual Confirmation

Satellite or aerial imagery provides verifiable evidence of damage, enhancing situational clarity.

The Outcome

3. From Alerts to Operational Awareness

By integrating these elements, the system transforms raw weather data into a structured, actionable model. Beyond notifications, it provides a verified, data-driven method for confirming property loss and strengthening consistency across post-event response For claims professionals, this integration supports:

Early identification of verified impact zones.

Resources assigned through data-backed assessment of community needs.

Field coordination enhanced by real-time visibility across impact zones.

Customizable property-level views and filters aligned with specific claim specializations.

Prioritization frameworks ensure teams address the most significant losses first.

Applied Operations Model

4. Turning Alerts into Action: Enabling Response Workflows

Acquiring technology is only the first step; implementation and adoption determine its true impact. When applied strategically, storm intelligence solutions like Dorothy Alerts power professionals to make faster, more informed decisions grounded in reliable data.

4.1 The Data Advantage

01

Scoring

Data allows professionals to prioritize properties based on indicators such as storm severity, proximity to the event, property type, etc.

02

Routing

Location-specific storm alerts can be automated into actions, linking impact to corresponding teams or outreach sequences.

03

Outreach

Based on the professional's specialty or criteria, alerts can trigger automatic delivery of pre-approved, compliant communication templates.

04

Monitoring

Accurate data enables organizations to measure communication effectiveness and maintain clear accountability throughout the process.

Conclusion

Looking Ahead: The Future of Real-Time Recovery

Dorothy continues to evolve its alert infrastructure through:

AI-powered damage pattern detection from new satellite sources

Drone integrations for ultra-local verification

Multi-state emergency dispatch expansion

From Awareness to Action

Recovery professionals have always been advocates for accuracy, fairness, and policyholders' rights. Now, they can be advocates faster.

Works Cited

Baird, B., Oldroyd, J. B., McElheran, K., & Elkington, D. (2011, March). The short life of online sales leads. Harvard Business Review. Retrieved from https://hbr.org/2011/03/the-short-life-of-online-sales-leads

Deloitte Insights. (2021, October 11). Emerging trends in claims transformation. Deloitte Development LLC. Retrieved from https://www2.deloitte.com/us/en/insights/industry/financial-services/insurance-claims-transformation.html

Federal Emergency Management Agency. (2025, March 14). Submitting your insurance documents to FEMA. U.S. Department of Homeland Security. Retrieved from https://agents.floodsmart.gov/sites/default/files/media/document/2025-07/fema-nfip-starting-your-recovery_fact-sheet-10-2021.pdf

J.D. Power. (2025, March 18). U.S. Property Claims Satisfaction Study. Retrieved from Insurance Claim Recovery Support: https://insuranceclaimrecoverysupport.com/customer-satisfaction-with-homeowners-insurance-property-claims-declines-to-7-year-low-amid-record-catastrophic-events-and-slower-than-ever-repair-times-j-d-power-finds/

Office of Program Policy Analysis & Government Accountability (Florida Legislature). (2010, January). Public adjuster representation in Citizens Property Insurance Corporation claims extends the time to reach a settlement and also increases payments to Citizens’ policyholders (Report No. 10-06). Retrieved from https://oppaga.fl.gov/Products/ReportDetail?rn=10-06

Oldroyd, J. B., McElheran, K., & Elkington, D. (2011). Lead response management study. MIT & InsideSales.com. Retrieved from https://cdn2.hubspot.net/hub/25649/file-13535879-pdf/docs/mit_study.pdf

United Policyholders. (2023). Aggregate survey findings, 2017–2023. Retrieved from https://uphelp.org/media/surveys/

United Policyholders. (2024, March). 2021 Marshall Fire 24-month survey report. United Policyholders. Retrieved from https://uphelp.org/wp-content/uploads/2024/03/2021-Marshall-Fire-24-Month-Survey-Report.pdf

United Policyholders. (n.d.). Open surveys and results: Compiled findings on underinsurance and claim education gaps. United Policyholders. Retrieved from https://uphelp.org/media/surveys/

Topic

Public Adjusters

Subscribe

Join our newsletter to stay up to date on features and releases.

Subscribe

Join our newsletter to stay up to date on features and releases.

January 7, 2025 | Reading Time: 10 Minutes

Licensed to Help: A Legal Expert’s Guide to Public Adjuster Ethics

By Brian S. Goodman, Esq. & General Counsel of NAPIA, and Arianna Armelli, Founder & CEO of Dorothy

About the Authors

Brian S. Goodman, Esq.,

Brian S. Goodman, Esq., is a Maryland attorney with over 40 years of experience specializing in tort and insurance litigation. He has extensive experience in general liability claims, personal injury cases, and first party property claims. Brian has served as General Counsel of the National Association of Public Insurance Adjusters (NAPIA) and is a board member of the Coalition Against Insurance Fraud.

Arianna Armelli

Arianna Armelli is the Founder and CEO of Dorothy, a data and technology company providing advanced storm intelligence and claims-readiness tools to public adjusters, attorneys, and restoration professionals. With a background in architecture, urban resilience, and climate modeling, she has spent over a decade building solutions that bridge weather, science, property risk, and the claims ecosystem.

A New Kind of Partnership: Why Dorothy Joined This Conversation — A note from our CEO, Arianna Armelli

Dorothy was founded after hearing hundreds of firsthand stories from policyholders dealing with delayed insurance payments — not because of missing paperwork, but due to prolonged disputes and opaque claim processes that the average policyholder has little experience navigating. These delays often left policyholders confused, financially strained, and unsure of what steps to take next.

In the early days, we believed the core issue was timing — that carriers simply took a long time to pay claims. Our initial solution focused on bridging that gap, offering short-term cash advances to help homeowners get through the waiting period between filing a claim and receiving payment. But through that work, we had the opportunity to speak directly with hundreds of policyholders and insurance specialists; a more serious issue became clear.

Many policyholders didn’t fully understand what their policies covered, why their claims were being disputed, or how those disputes impacted their final settlement. More critically, they didn’t know who to turn to for legitimate advocacy when the process became delayed or adversarial.

That realization shaped what we became next. Today, Dorothy works to improve access to clear information and trusted, licensed professionals through tools that help policyholders verify credentials, understand their options, and connect with ethical public adjusters and attorneys.

As we continued this work, we also saw a broader imbalance take shape. While significant investment has flowed into technology built for main insurance carriers, far less attention has been given to the licensed professionals working on the policyholder’s side of the process. Dorothy’s tools were built to help close that gap, supporting ethical public adjusters and disaster recovery professionals with better access to information, verification, and compliant ways to serve the people who rely on them.

This article reflects that shared commitment: helping policyholders understand the rules, identify responsible professionals, and avoid the risks that come from navigating complex claims alone.

The Policyholders’ Guide to Ethical Public Adjusting

As the saying goes, “When it rains, it pours.” For policyholders, the aftermath of the storm often brings more than water or wind damage. It can be a chaotic time, often marked by delays in the insurance process, a rush of unsolicited assistance, or both.

Property recovery requires clear decisions made under pressure. But instead of getting reliable help, many policyholders and business owners face a different challenge: identifying who is legally authorized to advise them. That uncertainty creates a vulnerable window, often filled by well-meaning, yet unqualified individuals offering help they are not legally allowed to provide.

This uncertainty is exactly why platforms like Dorothy have stepped in—not to replace the profession, but to reinforce it. By verifying licenses, tracking outreach, and connecting policyholders only with vetted adjusters, technology can help close the gaps that have historically left policyholders vulnerable.

Still, in the stressful days after a storm, it can be difficult to tell who is qualified and who isn’t. Even well-intentioned individuals can overstep, and the consequences can be serious. That’s why understanding the distinction between lawful public adjusting services and prohibited solicitation is critical.

This article outlines the key solicitation laws, the common missteps policyholders may encounter after a storm, and the steps they can take to protect themselves.

1. The Ethical Line: What Help Is Legal, and What Isn’t?

In nearly every state, only two professionals are legally allowed to negotiate or interpret an insurance claim on your behalf:

A licensed public adjuster

A licensed attorney

Anyone else — a roofer, restoration contractor, handyman, “claims consultant,” or general contractor — steps into illegal territory the moment they start dealing with your insurer for you. This is called the Unauthorized Practice of Public Adjusting (UPPA), and it’s more common than most people realize.

UPPA can void contracts, delay settlements, trigger disputes, and leave policyholders without recourse if something goes wrong. The key is working with someone who’s licensed, trained, and bound by rules that protect you. And when that person isn’t licensed, the consequences fall entirely on the policyholder.

Public adjusters are also frequently misunderstood. Some insurance industry messaging has cast PAs as “predatory,” which leaves policyholders unsure about who to trust. In reality, licensed public adjusters operate under strict ethical rules and take those obligations seriously. Like any profession, there are a few bad actors — but broad stigma only pushes homeowners toward the actual risk: unlicensed individuals operating without any ethical or legal accountability.

These laws aren’t red tape. They exist so that, on your worst day, you have someone who’s actually qualified to sit on your side of the table. — Brian Goodman, Esq.

2. What a Licensed Public Adjuster Actually Does

Think of a public adjuster as your claims advocate: someone who knows the laws, understands your policy, and represents your financial interests.

A licensed PA typically:

Inspects and documents the damage

Reads and interprets the policy coverage

Compiles estimates and claim documents

Negotiates the claim within the bounds of state law

Ensures the settlement reflects actual loss and coverage

This is not a casual skillset. In most states, public adjusters must complete licensing exams, pass background checks, secure bonding, and maintain ongoing continuing education—often including ethics requirements. They are also subject to regular renewal and compliance reviews every one to two years. That means there is a paper trail, a license to verify, and a state regulator watching. Contractors, roofers, and consultants provide valuable services but they cannot legally interpret coverage or negotiate claims unless they are separately licensed as PAs or attorneys.

Who’s Allowed to Negotiate Your Insurance Claim?

Public Adjuster

Who They Work For

The policyholder (you)

What They Can Negotiate

Full insurance claim value on your behalf

Regulation

State-licensed and regulated

Attorney

Who They Work For

The policyholder (usually in legal disputes)

What They Can Negotiate

Legal aspects of claim, lawsuits, settlement

Regulation

Licensed by state bar associations

Contractor

Who They Work For

Themselves or hired by you

What They Can Negotiate

Scope of work, materials, timelines (NOT the claim)

Regulation

Licensed contractor, not permitted to negotiate insurance

Insurance Adjuster

Who They Work For

The insurance company

What They Can Negotiate

Claim amounts in favor of the insurer

Regulation

Employed by or contracted with insurer; state oversight

3. Where Things Go Wrong: The Everyday Forms of UPPA

The most common UPPA violations don’t come from bad intentions. they come from confusion and overconfidence. A roofer thinks he’s helping. A “consultant” believes he’s saving you time. Contractors, consultants, and sales reps overstep because they believe they’re helping, not because they intend to break the law. But by the time the policyholder realizes it, the damage is usually already done.

How a Claim Goes Off Track

1

Policyholder Starts Claim

Files initial claim after damage occurs.

2

Unlicensed Person Involved

A contractor or unlicensed person begins handling parts of the claim.

3

Claim Disrupted

Insurance company denies or delays the claim due to unauthorized negotiations.

4

Needs Professional Help

Policyholder hires a licensed adjuster or attorney to get the claim back on track.

4. How Dorothy Is Addressing the Access Gap

Dorothy approaches this problem as a technology company focused on clarity and access, working alongside existing rules and enforcement frameworks.

Licensing plays an important role in protecting policyholders, but it is only one part of the picture. After a loss, people are often meeting professionals for the first time under stressful circumstances. In those moments, they need more than confirmation that someone is licensed. They need context. Who is this person? What kind of work have they done? Have others had good experiences working with them?

This reality is one of the reasons Dorothy built Bestpublicadjuster.org, a free, public-facing directory designed to help policyholders verify a professional’s license before ever taking a first meeting, and to better understand who they are choosing to work with.

Policyholders can check credentials, reviews, and service areas, and book consultations without pressure or uncertainty. By making this information easier to access upfront, Dorothy aims to support the work of regulators, reduce confusion for homeowners, and help ethical professionals stand out in moments when trust matters most.

Who Enforces UPPA?

UPPA enforcement can sometimes fall to the individual state departments of insurance, but these agencies often do not have any plenary power over contractors or roofers. Some states make UPPA a misdemeanor crime, and in those instances the jurisdiction and penalties are enforced by State prosecutorial agencies, such as the Attorney General or States’ attorneys office. As a result of this reality, many violations slip through due to understaffed agencies or the fact that these are not typical crimes subject to quick prosecution. This gap allows unlicensed actors to operate for longer than they should, without accountability for the harm they cause. This creates confusion for policyholders and frustration for ethical, licensed professionals.

Awareness around licensed public adjusters is still far too low, and that gap allows unlicensed individuals to step into roles they legally shouldn’t. We built Bestpublicadjuster.org to change the landscape: to elevate licensed PAs, broaden consumer understanding, and give policyholders a trusted way to verify a professional before they engage. — Arianna Armelli, Founder & CEO of Dorothy

When stress is high, quick decisions can backfire. It’s important to slow things down and vet anyone offering help.

5. Ethical vs. Unethical Solicitation: How to Tell the Difference

Ethical Behaviors (Green Flags)

Provides full name + license number immediately

Shows you how to verify their license

Offers a clear, compliant written contract

Encourages you to take your time, ask questions, or consult others

Explains fees & costs transparently

Unethical or Illegal Behaviors (Red Flags)

Pressure to sign immediately

Implying state, FEMA, or insurance affiliation without proof

Asking you to sign over your insurance check

Refusing to give a license number

Contracts full of vague or overly broad language

Every public adjuster listed through Dorothy and BestPA.org must meet strict licensing and ethical standards. Licenses are verified with state Departments of Insurance, and unlicensed individuals, or consultants are not permitted on the platform. Policyholders can review credentials, background information, and service details before scheduling a consultation.

Ethics require more than rules on paper. Our role as a technology company is to build systems that make ethical choices easier.

5.1 Technology’s Role in Raising the Bar

Technology can support ethical practices when it is built with a clear understanding of the rules that already exist. At Dorothy, that means learning directly from legal and industry experts like Brian Goodman as we build and refine our platform.

We work with experts to understand how solicitation laws vary by state and where confusion most often occurs, using that insight to shape how our tools encourage compliant, ethical use. That guidance informs how professionals are verified and how policyholders are invited to engage.

Topic

Public Adjusters

Topic

Public Adjusters

We are not public adjusters, and we do not pretend to be. What we do care about is helping people recover after disaster and building technology that supports the professionals who advocate for them. When the right tools, information, and people come together, recovery becomes clearer, fairer, and faster. — Arianna Armelli, Founder & CEO of Dorothy

6. Why Ethics Matter And Who They Protect

Ethics in public adjusting are about people. When adjusters follow legal and ethical standards:

Policyholders get fair, timely settlements

Insurers experience fewer disputes

Contractors get clearer scopes

Communities recover faster

When they don’t, ripple effects spread across everyone involved. Claims get delayed and the trust that should exist between consumers and professionals erodes.

This is also where technology and transparency tools — including platforms like Dorothy — can help rebuild trust. By verifying licenses, tracking outreach, and giving policyholders clarity, tech can support ethical professionals and create better outcomes.

Reform, Oversight, and What’s Coming Next

The industry isn’t standing still. States like Texas and Oklahoma have introduced clearer rules around solicitation, contract standards, and UPPA enforcement. National organizations like NAPIA continue pushing for stronger consumer protections and consistent licensing requirements. As states strengthen their UPPA and solicitation rules, technology will play a bigger role in enforcement and consumer education. Platforms like Dorothy can help regulators, adjusters, and policyholders align around a shared goal: a clearer, more trustworthy claims process.

Real improvement comes from giving the rules we already have real weight. That means consistent enforcement, clear expectations, and resources for regulators to act when something goes wrong. Tools that help connect licensed adjusters with the policyholders who need them can also bring more order and transparency to the process.

Recovering from property damage is exhausting. No one should have to face complex insurance issues alone. Ethical public adjusting ensures policyholders receive the support, clarity, legal protection, and advocacy they deserve — from someone who’s truly on their side and licensed to help.

Topic

Public Adjusters

Topic

Public Adjusters

If someone tells you they’re a public adjuster, you should be able to verify that license in minutes. If you can’t find them on your Department of Insurance website, that’s your sign to walk away. — Brian Goodman, Esq.

Subscribe

Join our newsletter to stay up to date on features and releases.

Subscribe

Join our newsletter to stay up to date on features and releases.

January 7, 2025 | Reading Time: 10 Minutes

Licensed to Help: A Legal Expert’s Guide to Public Adjuster Ethics

By Brian S. Goodman, Esq. & General Counsel of NAPIA, and Arianna Armelli, Founder & CEO of Dorothy

About the Authors

Brian S. Goodman, Esq.,

Brian S. Goodman, Esq., is a Maryland attorney with over 40 years of experience specializing in tort and insurance litigation. He has extensive experience in general liability claims, personal injury cases, and first party property claims. Brian has served as General Counsel of the National Association of Public Insurance Adjusters (NAPIA) and is a board member of the Coalition Against Insurance Fraud.

Arianna Armelli

Arianna Armelli is the Founder and CEO of Dorothy, a data and technology company providing advanced storm intelligence and claims-readiness tools to public adjusters, attorneys, and restoration professionals. With a background in architecture, urban resilience, and climate modeling, she has spent over a decade building solutions that bridge weather, science, property risk, and the claims ecosystem.

A New Kind of Partnership: Why Dorothy Joined This Conversation — A note from our CEO, Arianna Armelli

Dorothy was founded after hearing hundreds of firsthand stories from policyholders dealing with delayed insurance payments — not because of missing paperwork, but due to prolonged disputes and opaque claim processes that the average policyholder has little experience navigating. These delays often left policyholders confused, financially strained, and unsure of what steps to take next.

In the early days, we believed the core issue was timing — that carriers simply took a long time to pay claims. Our initial solution focused on bridging that gap, offering short-term cash advances to help homeowners get through the waiting period between filing a claim and receiving payment. But through that work, we had the opportunity to speak directly with hundreds of policyholders and insurance specialists; a more serious issue became clear.

Many policyholders didn’t fully understand what their policies covered, why their claims were being disputed, or how those disputes impacted their final settlement. More critically, they didn’t know who to turn to for legitimate advocacy when the process became delayed or adversarial.

That realization shaped what we became next. Today, Dorothy works to improve access to clear information and trusted, licensed professionals through tools that help policyholders verify credentials, understand their options, and connect with ethical public adjusters and attorneys.

As we continued this work, we also saw a broader imbalance take shape. While significant investment has flowed into technology built for main insurance carriers, far less attention has been given to the licensed professionals working on the policyholder’s side of the process. Dorothy’s tools were built to help close that gap, supporting ethical public adjusters and disaster recovery professionals with better access to information, verification, and compliant ways to serve the people who rely on them.

This article reflects that shared commitment: helping policyholders understand the rules, identify responsible professionals, and avoid the risks that come from navigating complex claims alone.

The Policyholders’ Guide to Ethical Public Adjusting

As the saying goes, “When it rains, it pours.” For policyholders, the aftermath of the storm often brings more than water or wind damage. It can be a chaotic time, often marked by delays in the insurance process, a rush of unsolicited assistance, or both.

Property recovery requires clear decisions made under pressure. But instead of getting reliable help, many policyholders and business owners face a different challenge: identifying who is legally authorized to advise them. That uncertainty creates a vulnerable window, often filled by well-meaning, yet unqualified individuals offering help they are not legally allowed to provide.

This uncertainty is exactly why platforms like Dorothy have stepped in—not to replace the profession, but to reinforce it. By verifying licenses, tracking outreach, and connecting policyholders only with vetted adjusters, technology can help close the gaps that have historically left policyholders vulnerable.

Still, in the stressful days after a storm, it can be difficult to tell who is qualified and who isn’t. Even well-intentioned individuals can overstep, and the consequences can be serious. That’s why understanding the distinction between lawful public adjusting services and prohibited solicitation is critical.

This article outlines the key solicitation laws, the common missteps policyholders may encounter after a storm, and the steps they can take to protect themselves.

1. The Ethical Line: What Help Is Legal, and What Isn’t?

In nearly every state, only two professionals are legally allowed to negotiate or interpret an insurance claim on your behalf:

A licensed public adjuster

A licensed attorney

Anyone else — a roofer, restoration contractor, handyman, “claims consultant,” or general contractor — steps into illegal territory the moment they start dealing with your insurer for you. This is called the Unauthorized Practice of Public Adjusting (UPPA), and it’s more common than most people realize.

UPPA can void contracts, delay settlements, trigger disputes, and leave policyholders without recourse if something goes wrong. The key is working with someone who’s licensed, trained, and bound by rules that protect you. And when that person isn’t licensed, the consequences fall entirely on the policyholder.

Public adjusters are also frequently misunderstood. Some insurance industry messaging has cast PAs as “predatory,” which leaves policyholders unsure about who to trust. In reality, licensed public adjusters operate under strict ethical rules and take those obligations seriously. Like any profession, there are a few bad actors — but broad stigma only pushes homeowners toward the actual risk: unlicensed individuals operating without any ethical or legal accountability.

Licensed to Help: A Legal Expert’s Guide to Public Adjuster Ethics

These laws aren’t red tape. They exist so that, on your worst day, you have someone who’s actually qualified to sit on your side of the table. — Brian Goodman, Esq.

2. What a Licensed Public Adjuster Actually Does

Think of a public adjuster as your claims advocate: someone who knows the laws, understands your policy, and represents your financial interests.

A licensed PA typically:

Inspects and documents the damage

Reads and interprets the policy coverage

Compiles estimates and claim documents

Negotiates the claim within the bounds of state law

Ensures the settlement reflects actual loss and coverage

This is not a casual skillset. In most states, public adjusters must complete licensing exams, pass background checks, secure bonding, and maintain ongoing continuing education—often including ethics requirements. They are also subject to regular renewal and compliance reviews every one to two years. That means there is a paper trail, a license to verify, and a state regulator watching. Contractors, roofers, and consultants provide valuable services but they cannot legally interpret coverage or negotiate claims unless they are separately licensed as PAs or attorneys.

Who’s Allowed to Negotiate Your Insurance Claim?

Public Adjuster

Who They Work For

The policyholder (you)

What They Can Negotiate

Full insurance claim value on your behalf

Regulation

State-licensed and regulated

Attorney

Who They Work For

The policyholder (usually in legal disputes)

What They Can Negotiate

Legal aspects of claim, lawsuits, settlement

Regulation

Licensed by state bar associations

Insurance Adjuster

Who They Work For

The insurance company

What They Can Negotiate

Claim amounts in favor of the insurer

Regulation

Employed by or contracted with insurer; state oversight

Contractor

Who They Work For

Themselves or hired by you

What They Can Negotiate

Scope of work, materials, timelines (NOT the claim)

Regulation

Licensed contractor, not permitted to negotiate insurance

3. Where Things Go Wrong: The Everyday Forms of UPPA

The most common UPPA violations don’t come from bad intentions. they come from confusion and overconfidence. A roofer thinks he’s helping. A “consultant” believes he’s saving you time. Contractors, consultants, and sales reps overstep because they believe they’re helping, not because they intend to break the law. But by the time the policyholder realizes it, the damage is usually already done.

How a Claim Goes Off Track

1

Policyholder Starts Claim

Files initial claim after damage occurs.

2

Unlicensed Person Involved

A contractor or unlicensed person begins handling parts of the claim.

3

Claim Disrupted

Insurance company denies or delays the claim due to unauthorized negotiations.

4

Needs Professional Help

Policyholder hires a licensed adjuster or attorney to get the claim back on track.

Top Adjuster

ABC Adjusters International

347 Reviews

For over 80 years, ABC Adjusters International has helped thousands of families who have been forced out of their home due to a fire, water loss, or any type of disaster.

Primary Contact

Smith, Steve C

Website

https://abcadjustment.com

ssmith@abcadjustment.com

Address

500 Easton Rd. Baltimore, MD

Phone

555-222-2209

4. How Dorothy Is Addressing the Access Gap

Dorothy approaches this problem as a technology company focused on clarity and access, working alongside existing rules and enforcement frameworks.

Licensing plays an important role in protecting policyholders, but it is only one part of the picture. After a loss, people are often meeting professionals for the first time under stressful circumstances. In those moments, they need more than confirmation that someone is licensed. They need context. Who is this person? What kind of work have they done? Have others had good experiences working with them?

This reality is one of the reasons Dorothy built Bestpublicadjuster.org, a free, public-facing directory designed to help policyholders verify a professional’s license before ever taking a first meeting, and to better understand who they are choosing to work with.

Policyholders can check credentials, reviews, and service areas, and book consultations without pressure or uncertainty. By making this information easier to access upfront, Dorothy aims to support the work of regulators, reduce confusion for homeowners, and help ethical professionals stand out in moments when trust matters most.

Who Enforces UPPA?

UPPA enforcement can sometimes fall to the individual state departments of insurance, but these agencies often do not have any plenary power over contractors or roofers. Some states make UPPA a misdemeanor crime, and in those instances the jurisdiction and penalties are enforced by State prosecutorial agencies, such as the Attorney General or States’ attorneys office. As a result of this reality, many violations slip through due to understaffed agencies or the fact that these are not typical crimes subject to quick prosecution. This gap allows unlicensed actors to operate for longer than they should, without accountability for the harm they cause. This creates confusion for policyholders and frustration for ethical, licensed professionals.

Awareness around licensed public adjusters is still far too low, and that gap allows unlicensed individuals to step into roles they legally shouldn’t. We built Bestpublicadjuster.org to change the landscape: to elevate licensed PAs, broaden consumer understanding, and give policyholders a trusted way to verify a professional before they engage. — Arianna Armelli, Founder & CEO of Dorothy

When stress is high, quick decisions can backfire. It’s important to slow things down and vet anyone offering help.

5. Ethical vs. Unethical Solicitation: How to Tell the Difference

Ethical Behaviors (Green Flags)

Provides full name + license number immediately

Shows you how to verify their license

Offers a clear, compliant written contract

Encourages you to take your time, ask questions, or consult others

Explains fees & costs transparently

Unethical or Illegal Behaviors (Red Flags)

Pressure to sign immediately

Implying state, FEMA, or insurance affiliation without proof

Asking you to sign over your insurance check

Refusing to give a license number

Contracts full of vague or overly broad language

Every public adjuster listed through Dorothy and BestPA.org must meet strict licensing and ethical standards. Licenses are verified with state Departments of Insurance, and unlicensed individuals, or consultants are not permitted on the platform. Policyholders can review credentials, background information, and service details before scheduling a consultation.

Ethics require more than rules on paper. Our role as a technology company is to build systems that make ethical choices easier.

5.1 Technology’s Role in Raising the Bar

Technology can support ethical practices when it is built with a clear understanding of the rules that already exist. At Dorothy, that means learning directly from legal and industry experts like Brian Goodman as we build and refine our platform.

We work with experts to understand how solicitation laws vary by state and where confusion most often occurs, using that insight to shape how our tools encourage compliant, ethical use. That guidance informs how professionals are verified and how policyholders are invited to engage.